Starting and running a small business, especially in the field of cybersecurity, can be challenging, and economic downturns or recessions can add additional obstacles to overcome. However, with the right financing options, such as those offered by Credibly, a reputable financial institution, you can take steps to recession-proof your cybersecurity business. Below we will explore how small business financing can help you navigate through economic uncertainties and keep your cybersecurity business thriving.

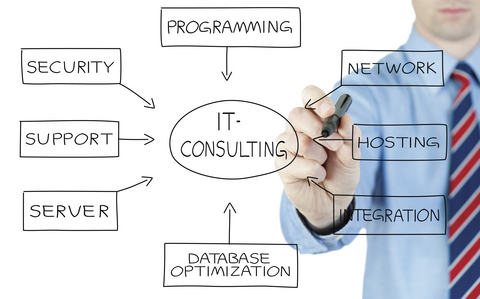

Understanding Small Business Financing:

Reputable lenders offer a range of financing options designed specifically for small businesses. These options include small business loans, working capital loans, and merchant cash advances, which can provide the necessary funds to cover various business expenses, such as purchasing cybersecurity equipment, hiring skilled employees, or expanding your operations.

One significant advantage of small business financing is its flexibility. These small business financing lenders understand the unique needs of small businesses and offer customized financing solutions to fit your specific requirements. Whether you need a short-term loan to cover immediate expenses or a long-term loan to finance a significant expansion, these lenders can tailor financing options that align with your business goals and cash flow.

How Small Business Financing Can Help Recession-Proof Your Cybersecurity Business:

Ensuring Adequate Cash Flow: Economic downturns or recessions can disrupt cash flow for small businesses, making it challenging to cover essential expenses, such as payroll, rent, or inventory. With small business financing, you can access the necessary funds to bridge cash flow gaps and ensure the smooth operation of your cybersecurity business during challenging times. This can help you weather the storm and stay financially stable, reducing the risk of business failure.

Investing in Cybersecurity Equipment and Technology:

As a cybersecurity business, staying up-to-date with the latest technology and equipment is critical to providing top-notch services to your clients. However, purchasing cybersecurity equipment or upgrading technology can be costly, especially during an economic downturn. With small business financing, you can access the funds needed to invest in cutting-edge cybersecurity equipment and technology, giving you a competitive edge and positioning your business for long-term success.

Hiring Skilled Employees:

Your cybersecurity business’s success relies heavily on the expertise and skills of your employees. However, recruiting and retaining top talent can be challenging, especially during economic uncertainties. Small business financing can help you attract and retain skilled employees by providing the funds to offer competitive salaries and benefits packages. This can help you build a strong team that can navigate through challenging times and keeps your cybersecurity business running smoothly.

Expanding Your Operations:

Economic downturns or recessions can also present unique opportunities for business expansion, such as acquiring a competitor or expanding into new markets. However, expansion requires capital, which may be challenging to obtain during uncertain economic times. Small business financing can provide you with the necessary funds to seize expansion opportunities and position your cybersecurity business for growth, even during a recession.

Diversifying Revenue Streams:

Relying on a single source of revenue can be risky for any business, especially during economic downturns when customer demand may fluctuate. Diversifying your revenue streams can help mitigate risks and provide stability to your business. Small business financing can enable you to invest in diversification strategies, such as developing new cybersecurity services or entering new markets, reducing your reliance on a single revenue source and helping you recession-proof your business.

In conclusion, small business financing can be a valuable tool to recession-proof your cybersecurity business. By providing access to funds for essential aspects of your cybersecurity business, you are able to extend your runway and reduce the potential of having your business fail.